Following on from my post on understanding your electricity bill, here we aim to improve your understanding of your Irish Natural Gas bills.

The Detail

The first step when comparing any bill is to check the billing period, as the number of billing days in each month vary having an effect on your bottom line, often you will find with gas bills that they are either estimated (indicated by the letter E after the meter reading value) or have a consumption period that is not the standard calendar month due to manually meter readings.

You should continue through your bill comparing each line item with the previous months, the consumption can of course vary depending on the operations at your site but you should be aware of these changes and understand how they impact on consumption and cost (e.g. there was a particularly cold snap and the heating was running for longer). Look for any one line item that appears to have increase considerably and question why this is?

There are two main ways to reduce the cost of your gas energy bill:

• Reduce your energy consumption

• Change/Negotiate a more favourable tariff with your utility supplier

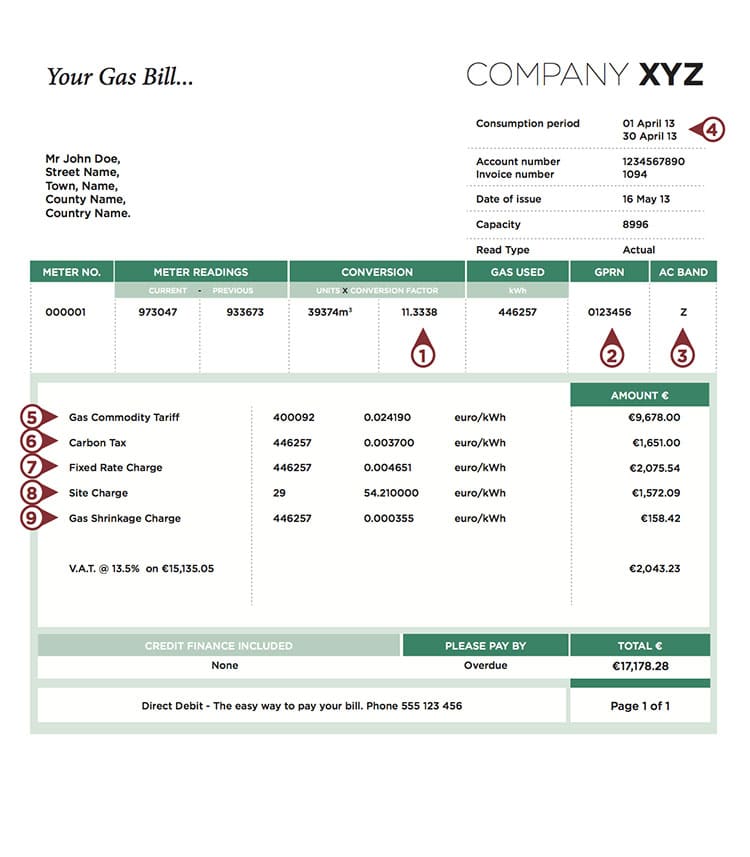

Your Gas Bill Explained

Here is a typical gas bill. We have marked the main items and provide an explanation below:

1. Conversion Factor

The conversion factor is a metric used to convert the m3 “meters cubed” of gas that you consumed and translates it into kWh “kilo Watt hours” of energy consumed. This metric is subject to minor changes on monthly bases from your utility supplier.

2. GPRN

“Gas Point Reference Number” is your unique identification code which identity’s your meter and connection to the main gas network.

3. AC Band

The AC Band is a letter that identifies the amount of energy you typically consume in a year. This can impact on your Gas Commodity Tariff which you negotiate with your utility supplier. The bands are as follows….

A: Less than 6,000kWh

B: 6,000kWh to 23,500kWh

C: 23,500kWh to 73,000kWh

X: 73,000kWh to 750MWh

Y: 750MWh to 5,500MWh.

4. Consumption Period

Is the period of time that the bill is calculated on April 1 – April 30.

5. Gas Commodity Charge

The gas commodity charge (cent per kWh) reflects the monthly unit rate of wholesale gas. Natural gas is purchased in sterling on your behalf in the UK natural gas wholesale market. The cost of natural gas varies according to demand and supply.

6. Carbon Tax

This is a governmental charge implemented to tax all co2 emissions. The amount of co2 emitted depends on how much energy you consume. Example 0.194 kg CO2 / kWh of energy consumed or 11 kWh/m3 so that’s 2.134 kg CO2 / m3.

7. Fixed Rate Charge

The Fixed Rate Charge (c/kWh) incorporates those costs which depend on the volume of gas supplied where the appropriate rate of cost recovery (per kWh consumed) remains constant through the gas year and does not vary between customers. This charge consists of transmission commodity tariffs, distribution commodity tariffs, UK transportation costs, swing flexibility and an approved margin on total costs. This is a per kWh charge for the provisioning of gas to your site.

8. Site Charge

The standing charge that appears on customers’ bills for both gas and electricity goes toward the maintenance of the countries gas and electricity infrastructure i.e. gas pipes and electricity pylons. This charge is a fixed daily rate, market pressures influence what the utilities choose to apply.

9. Gas Shrinkage Charge

Gas Shrinkage charge means the cost of the Natural Gas which is used by the Transporter for the operation of the Transportation System including, inter alia, at compressor stations and lost or otherwise unaccounted for from the Transportation System or any part of the Transportation System.