After a couple of days of reflection on the first consequences of the Brexit vote have materialised.How is this likely to affect the UK energy market?The immediate impact will be the weakness of the pound against the US$. The 14% drop to date has now been reflected directly in the gas price.

This steep drop is projected to continue with financial industry predictions of it levelling out at 20% below the pre-referendum US$ rate. Electricity prices will rise correspondingly into a double-digit percentage.

What is of more long term concern is the impact on the generation investments planned over the next 10 years. Uncertainty requires greater return as compensation for the increased risk. This has already been reflected in the loss of the UK’s AAA rating. The UK generation network requires over £14Billion investment of which over 50% will be from European suppliers. The scale of this means a significant increase in the cost of finance, which will add significantly to the long-term fixed costs of energy in the UK.

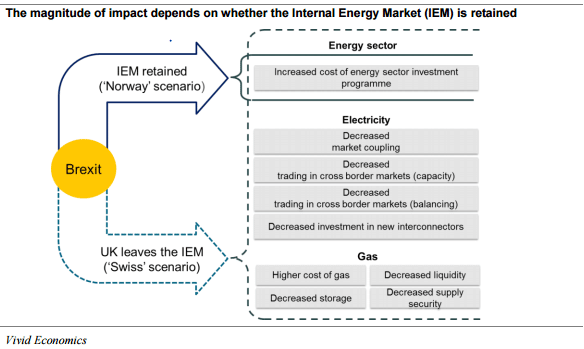

A study commissioned of Vivid economics by National Grid in March flagged the energy sector market forces. Their assessment was that higher costs of investment in energy infrastructure are the most significant Brexit risk.

So in short:

Electricity costs will likely increase significantly in 2016 and rise further in the following 2 years leading up to Brexit. The only option to maintain energy costs will be to invest heavily in the managed reduction of energy use.