A recent study was published in the UK regarding their Carbon Tax and the impact it had on the percentage of the total electricity generated in the country that came from fossil fuels, specifically coal.

The amount of electricity produced by coal on the UK grid fell by 37% over a 6-year period since the Carbon Tax was introduced (from 40% to 3%).

The Tax added on average just £39 to the British electricity bills and collected somewhere in the region of £790m for the Treasury in 2018. Interestingly, the interconnector that connects the European grid to the UK caused a reduction in the price of electricity for the UK market and an increase in cost for the French & Dutch markets primarily.

Late in 2019, the go-ahead was given for the Celtic Interconnector an undersea cable connecting the Irish and French electricity grids. The proposed cable will have a capacity of 700MW, enough to power 450,000 homes. Much like its counterpart in the UK, it is hoped that this cable would reduce the overall cost of electricity in Ireland by joining it up to the larger market in France.

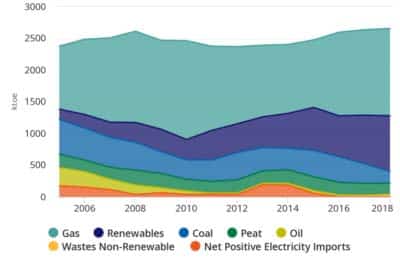

Ireland has seen a similar decrease in the amount of coal-fired generation over the last number of years, but natural gas is still the primary method for electricity generation in this country. The proposed increase to the Carbon Tax over the next 10 years will cause an increase in the cost of the electricity generated from all fossil fuels and this impact will be most felt from electricity generated from Natural Gas.

The below graph from the SEAI shows the change in how Ireland is generating its electricity over a period of 12 years. The overall trend of renewables shows an increase while the generation from most fossil fuels is showing a decrease.

The new Renewable Electricity Support Scheme (RESS) should increase the total amount of our electricity produced by renewable sources over the next 10 years as the plans are brought to fruition. This, combined with the increased Carbon Tax, should see the relative cost of renewable electricity decrease and therefore encourage investment & use from those sources.

Although the Carbon Tax looks like it will end up costing the end consumer a lot of money, if done properly it can actually decrease the overall dependence on fossil fuels while only incurring a small increase on the end-users electricity bill.

To discuss any of the information outlined above, contact us by clicking below and request to speak to one of our specialists.